Скачать с ютуб Learn THIS before Trading Options - The GREEKS explained for beginners & how options are priced в хорошем качестве

option greeks

option greeks explained

how to use option greeks

options trading greeks

option greeks 101

options greeks

options greeks explained

greek options

greek options explained

greek options trading

option greeks tutorial

options trading tutorial

options trading

options trading for beginners

options trading basics

Скачать бесплатно и смотреть ютуб-видео без блокировок Learn THIS before Trading Options - The GREEKS explained for beginners & how options are priced в качестве 4к (2к / 1080p)

У нас вы можете посмотреть бесплатно Learn THIS before Trading Options - The GREEKS explained for beginners & how options are priced или скачать в максимальном доступном качестве, которое было загружено на ютуб. Для скачивания выберите вариант из формы ниже:

Загрузить музыку / рингтон Learn THIS before Trading Options - The GREEKS explained for beginners & how options are priced в формате MP3:

Если кнопки скачивания не

загрузились

НАЖМИТЕ ЗДЕСЬ или обновите страницу

Если возникают проблемы со скачиванием, пожалуйста напишите в поддержку по адресу внизу

страницы.

Спасибо за использование сервиса savevideohd.ru

Learn THIS before Trading Options - The GREEKS explained for beginners & how options are priced

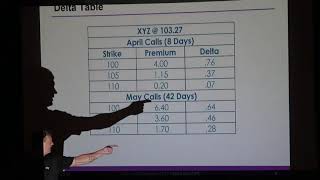

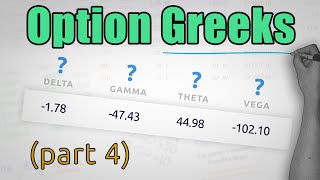

Live trade alerts & 1-on-1 coaching: / everythingoptions Get $100 & free Premium Discord when you deposit $500: https://tradearies.com/everythingoptions OPTION GREEKS are one of the most IMPORTANT parts to TRADING OPTIONS since they control EXACTLY how much money you MAKE or how much your option can LOSE! Stay tuned to the end of this video to learn about each of the Greeks and what affect they have on your OPTIONS PRICING. 🔗 LINKS 🔗 📈 Patreon: Join my Patron list to get access to live Q&A / trading sessions each week! https://www.patreon.com/gregtalksmone... 🗣 Discord: Join my FREE, active Discord with nearly 500 member where I post all of my trades and what stocks I'm watching! / discord 🤑 Robinhood: Sign up for Robinhood using my referral code to get 1 free stock! https://join.robinhood.com/gregorm466 📱 Social Media: Instagram: @gregtalksmoney Twitter: @gregtalksmoney TikTok: @gregtalksmoney 📄 Video Description 📄 DELTA: Delta plays the biggest role in options trading since it's typically the largest number value! The way Delta affects your options pricing is that for every $1 move in the underlying stock, the price of your option will move by the Delta value. This means if you have an option worth $100, with a Delta of 0.30, your option will change by $30 for every dollar the stock moves. GAMMA: Gamma controls Delta in the sense that for every dollar the stock moves, the Delta value will change by the Gamma value. Using our previous example of a $100 option, 0.30 Delta, and a 0.03 Gamma, for every dollar the stock moves the Delta value will change by 0.03. This means if the underlying stock moves $2 in the same direction, for the first dollar it moves, your option will change by the Delta value, and for the second dollar your option will change by the combination of the Delta and Gamma values. THETA: Theta is the option greek that will eat away at your options pricing everyday. This is because Theta is a negative value related to time, which is why you'll also hear it called "Time Decay." For every day that passes, your option will lose value equal to it's Theta. This means if your Theta is -0.15, for every day that passes your option will lose $15. As the expiration date on your option approaches, the Theta value will typically increase. VEGA: Vega is the wildest option greek due to the nature of volatility. For every % change in implied volatility, your option will change by its Vega value. Implied volatility is just as it sounds, the expected volatility from the underlying stock, but don't confuse this with current volatility! Typically, implied volatility drops when current volatility increases. If you buy an option on an earnings bet with a 60% implied volatility and a Vega value of 0.1, if your option loses 5% in implied volatility, your option will lose $50 in value. This is typical after an earnings report, where you'll see a fluctuation before the event, then a drop in implied volatility immediately after. RHO: Rho is the forgotten Greek but it still has some say in your option pricing. The reason why Rho is typically forgotten is because it's value is affected by the interest rates of risk free treasury bills, which hardly move. For every % change in the interest rates your option will change according to its Rho value. Typically Rho is more important for LEAP options than it is for short-term dated options since they typically have a higher Rho value. Personally, I love trading LEAPS and I don't pay attention to Rho since the interest rates hardly see any change. ⏱ TIMESTAMPS ⏱ Intro: 0:00 Delta: 0:35 Gamma: 3:17 Theta: 5:35 Vega: 7:41 Rho: 10:17 Discord: 11:55 Outro: 12:08 🏷 TAGS 🏷 option greeks,option greeks explained,how to use option greeks,option greeks calculator,option greeks strategies,options trading greeks,option greeks 101,options greeks,options greeks explained,greek options,greek options explained,greek options trading,how to calculate option greek,option greeks tutorial,options trading tutorial,options trading,options trading 101,how option options are priced,how options pricing works,options trading for beginners ⚠️ DISCLAIMER ⚠️ I am not a financial advisor. This video is for entertainment and educational purposes only. You (and only you) are responsible for the financial decisions that you mak