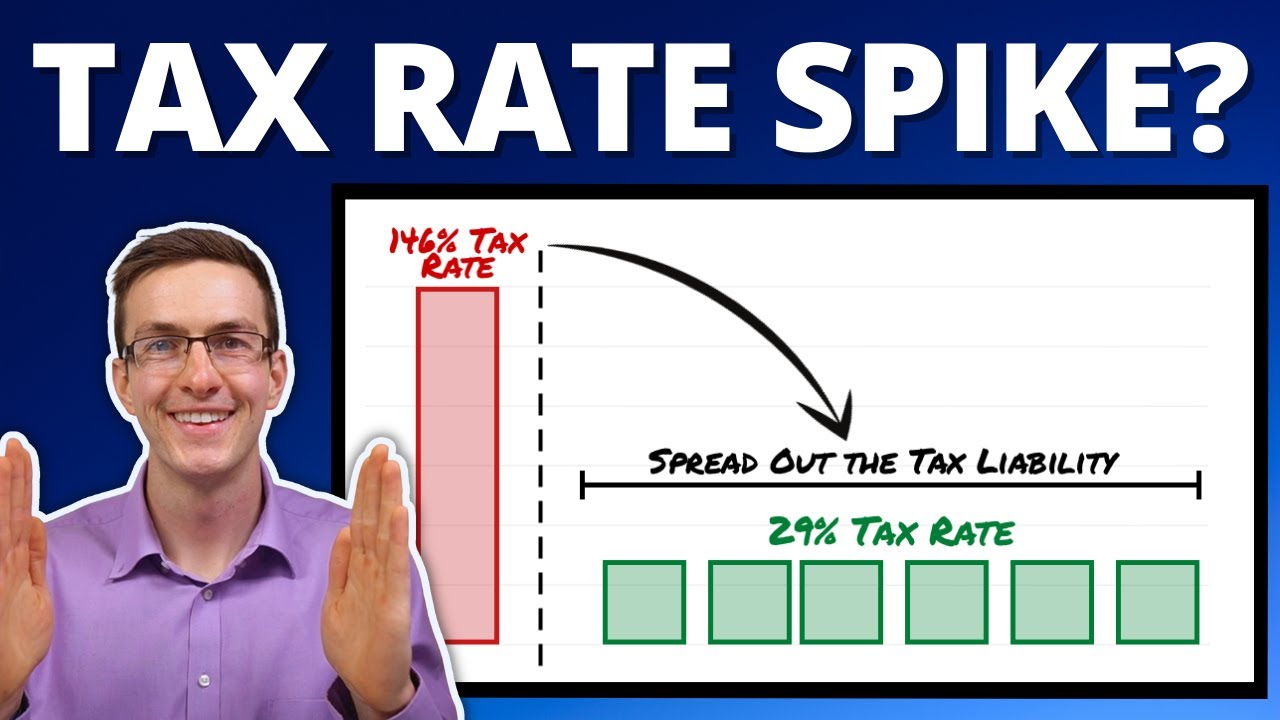

Retirement Tax Rate Spike? Do THIS to Spread Out Your Tax Liability… скачать в хорошем качестве

spread out tax liability

retirement tax rate spike

social security taxable

social security tax

social security taxation

retirement income planning

required minimum distribution

social security tax torpedo

tax strategies

medicare irmaa

medicare premiums

what is the medicare irmaa

how to avoid medicare penalties

medicare penalty cost

required minimum distributions

medicare premium

minimize rmds

avoiding rmds

provisional income

tax planning

rmds

lower taxes

Повторяем попытку...

Скачать видео с ютуб по ссылке или смотреть без блокировок на сайте: Retirement Tax Rate Spike? Do THIS to Spread Out Your Tax Liability… в качестве 4k

У нас вы можете посмотреть бесплатно Retirement Tax Rate Spike? Do THIS to Spread Out Your Tax Liability… или скачать в максимальном доступном качестве, видео которое было загружено на ютуб. Для загрузки выберите вариант из формы ниже:

-

Информация по загрузке:

Скачать mp3 с ютуба отдельным файлом. Бесплатный рингтон Retirement Tax Rate Spike? Do THIS to Spread Out Your Tax Liability… в формате MP3:

Если кнопки скачивания не

загрузились

НАЖМИТЕ ЗДЕСЬ или обновите страницу

Если возникают проблемы со скачиванием видео, пожалуйста напишите в поддержку по адресу внизу

страницы.

Спасибо за использование сервиса ClipSaver.ru

Retirement Tax Rate Spike? Do THIS to Spread Out Your Tax Liability…

Do you have a forward-looking tax plan that proactively lowers your future tax liability? Are you gaining the most from your current retirement tax plan? You can schedule an appointment with one of our Retirement Experts to look at your situation and help you plan for your future. Call us at (920) 544-0576 or go to https://www.safeguardinvest.com/contact. Many retirees will find themselves in a tax spike zone at some point in retirement. This can be from a medicare premium increase due to passing an IRMAA threshold, or you may find yourself paying higher taxes inside the Social Security Tax Torpedo. As a retiree takes additional income, they constantly need to think about every additional tax liability they encounter. And given the complexity of the retirement tax system, this isn't exactly easy. A mistake that I see too many retirees make is hitting a tax rate spike zone and simply accepting the tax spike as if there is nothing they can do about it. You almost always have an option or tax strategy you can implement. This might not help you save on taxes in the current year but can certainly set your situation up for a more tax-efficient future. For instance, a very strong strategy a retiree can implement is a 'spread the tax liability out' strategy. This involves taking on additional taxable income, in the form of a Roth Conversion or other retirement tax strategy, in order to max the bracket. This seems counterintuitive, but as we show in the video, can help save significantly on future tax liabilities. 0:00 Do You Face a Retirement Tax Rate Spike? 0:35 Lower the Impact of a Medicare Premium Increase 0:52 What is IRMAA? 1:43 IRMAA is a Tax Cliff 3:06 Example of a Strategy to Diffuse Your Medicare Penalty Tax Rate 4:29 Lower the Impact of the Social Security Tax Torpedo 8:06 Lower the Impact of a Capital Gain Bump Zone 10:40 3 Key Factors to Consider With This Strategy #RetirementIncomePlanning #TaxPlanning - - - - - - - - - - - - - - - - - - - - - Always remember, "You Don't Need More Money; You Need a Better Plan" 🍿 Subscribe to our channel: https://www.youtube.com/channel/UCVMA... 🏆 Join our 'Retirement Mastery' Facebook Group: https://bit.ly/retirement-mastery-group 📈 Talk with us about your retirement plan here: https://www.safeguardinvest.com/contact 📚 The New 60/40: How the Next Generation of Retirees Can Achieve Radical Financial Freedom through Better Safe Investing - https://www.amazon.com/New-60-Generat... Safeguard Wealth Management is a Registered Investment Advisor in the State of WI. Safeguard Wealth Management is not an insurance provider. All content on Youtube is for informational purposes only and should not be taken as personal advice for your situation. You can read more disclosures at https://www.safeguardinvest.com/fiduc...