Blue Owl Money Machine Sputters in Face of Private Credit Cracks скачать в хорошем качестве

Повторяем попытку...

Скачать видео с ютуб по ссылке или смотреть без блокировок на сайте: Blue Owl Money Machine Sputters in Face of Private Credit Cracks в качестве 4k

У нас вы можете посмотреть бесплатно Blue Owl Money Machine Sputters in Face of Private Credit Cracks или скачать в максимальном доступном качестве, видео которое было загружено на ютуб. Для загрузки выберите вариант из формы ниже:

-

Информация по загрузке:

Скачать mp3 с ютуба отдельным файлом. Бесплатный рингтон Blue Owl Money Machine Sputters in Face of Private Credit Cracks в формате MP3:

Если кнопки скачивания не

загрузились

НАЖМИТЕ ЗДЕСЬ или обновите страницу

Если возникают проблемы со скачиванием видео, пожалуйста напишите в поддержку по адресу внизу

страницы.

Спасибо за использование сервиса ClipSaver.ru

Blue Owl Money Machine Sputters in Face of Private Credit Cracks

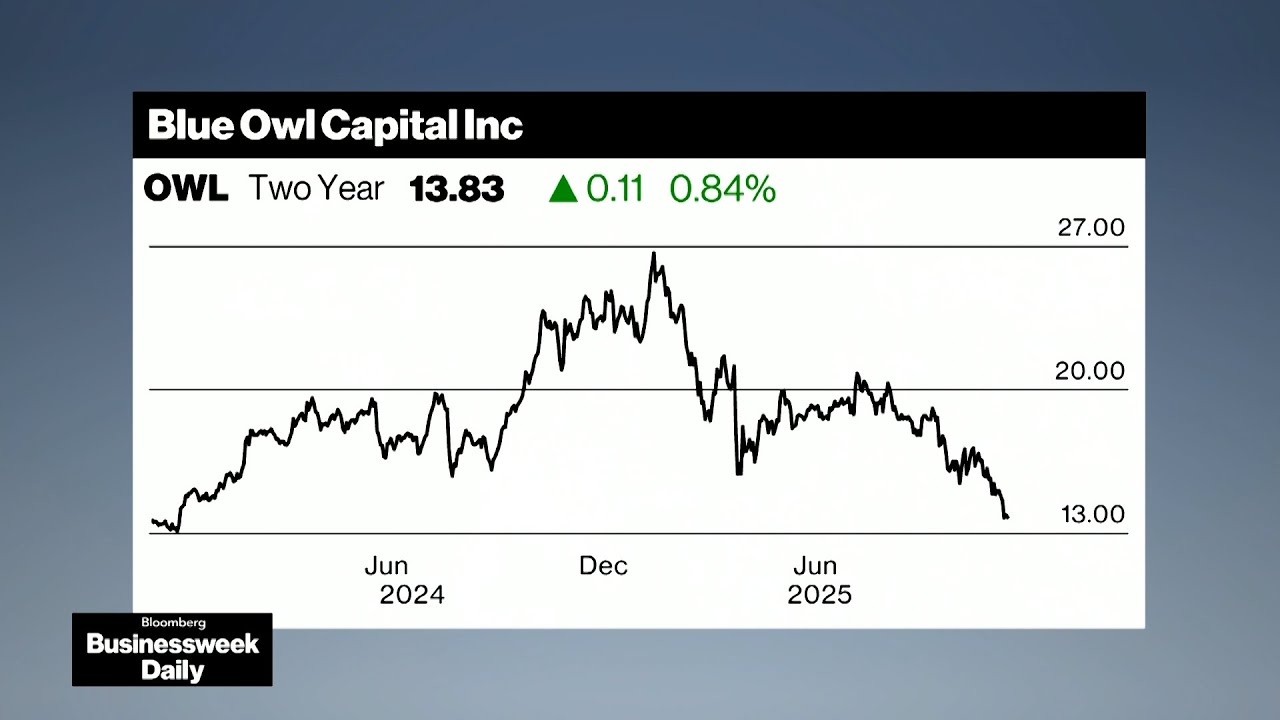

Blue Owl Capital Inc.’s Craig Packer has been something of a mainstay on the New York Stock Exchange in recent years, ringing the opening bell multiple times to toast the private credit giant’s public funds. On Wednesday, minutes after the market opened, his mood was anything but celebratory. Blue Owl had just announced it was scrapping a planned merger of two of its private credit funds, backtracking on a plan revealed Nov. 5 after scrutiny arose over the potential losses some investors would have to swallow as part of the deal. The parent company’s shares had fallen this week to the lowest level since 2023. Packer bemoaned “negative articles” about private credit that caused its stock to sink. When it comes to Blue Owl’s business development companies, the firm’s co-founder said on CNBC, “there’s no emergency here.”Bloomberg's Davide Scigliuzzo and Sridhar Natarajan joined Carol Massar and Tim Stenovec on 'Bloomberg Businessweek Daily' to break it down. The abrupt reversal is a rare egg-on-face moment for Blue Owl, which for years has been held up as the poster child of the boom times in the $1.7 trillion private credit market. Created as a merger between Owl Rock Capital and Dyal Capital Partners in 2021, it has pitched itself as a one-stop financing shop that can compete with banks and the biggest alternative asset managers. The attempted merger is also placing new scrutiny on Blue Owl, as it looks to transition away from the last vestiges of older fund models for investors. The private vehicle that was set to be folded into its larger public fund is the only remaining Blue Owl vehicles structured in such a way. It was designed to provide investors with some liquidity in the form of a listing, merger or a sale. After the spectacular collapses of First Brands Group and Tricolor Holdings, JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon has warned of weaker underwriting standards among non-bank lenders, while DoubleLine Capital CEO Jeffrey Gundlach blasted private credit as allowing for “garbage lending“ that could precipitate a financial crisis. In an interview with Bloomberg on Wednesday, Packer said that the fund has performed well and that Blue Owl will work with the fund’s board to figure out a liquidity solution for investors. “All options are on the table,” he said, including listing the fund or selling assets. “There may be other options that we may come up with in the next few months.” BDC Play In its early days, Blue Owl launched several private BDCs, which cater to wealthy individuals and are designed to provide them with an eventual exit. That model has been gradually replaced by so-called perpetual BDCs, which can raise money indefinitely. Over the years, Blue Owl has listed these older vehicles or merged them with public peers, a strategy that has proven to be profitable. When Blue Owl took its largest BDC public more than six years ago, gross proceeds from the listing totaled around $153 million, debuting at $15.30 per share. At the time, Packer dismissed questions on an earnings call about the firm’s rapid growth as envy or ignorance. Private credit then swelled on the heels of low rates, a pullback from banks and a widespread need for financing. In parallel, Blue Owl’s top brass have seen their own wealth grow dramatically. Co-founders Doug Ostrover, Marc Lipschultz and Michael Rees are each billionaires in their own right, according to the Bloomberg Billionaires Index. But stress has started to rise in private credit as borrowers have struggled with their liabilities. Rate cuts have also trimmed how much lenders can earn on loans, and firms have tightened spreads in an effort to win deals from banks. That outlook has led investors to shed their BDC holdings, leading to a significant drop in share prices. -------- Watch Bloomberg Radio LIVE on YouTube Weekdays 7am-6pm ET WATCH HERE: http://bit.ly/3vTiACF Follow us on X: / bloombergradio Subscribe to our Podcasts: Bloomberg Daybreak: http://bit.ly/3DWYoAN Bloomberg Surveillance: http://bit.ly/3OPtReI Bloomberg Intelligence: http://bit.ly/3YrBfOi Balance of Power: http://bit.ly/3OO8eLC Bloomberg Businessweek: http://bit.ly/3IPl60i Listen on Apple CarPlay and Android Auto with the Bloomberg Business app: Apple CarPlay: https://apple.co/486mghI Android Auto: https://bit.ly/49benZy Visit our YouTube channels: Bloomberg Podcasts: / bloombergpodcasts Bloomberg Television: / @markets Bloomberg Originals: / bloomberg Quicktake: / @bloombergquicktake