NPV vs. IRR скачать в хорошем качестве

Скачать видео с ютуб по ссылке или смотреть без блокировок на сайте: NPV vs. IRR в качестве 4k

У нас вы можете посмотреть бесплатно NPV vs. IRR или скачать в максимальном доступном качестве, видео которое было загружено на ютуб. Для загрузки выберите вариант из формы ниже:

-

Информация по загрузке:

Скачать mp3 с ютуба отдельным файлом. Бесплатный рингтон NPV vs. IRR в формате MP3:

Если кнопки скачивания не

загрузились

НАЖМИТЕ ЗДЕСЬ или обновите страницу

Если возникают проблемы со скачиванием видео, пожалуйста напишите в поддержку по адресу внизу

страницы.

Спасибо за использование сервиса ClipSaver.ru

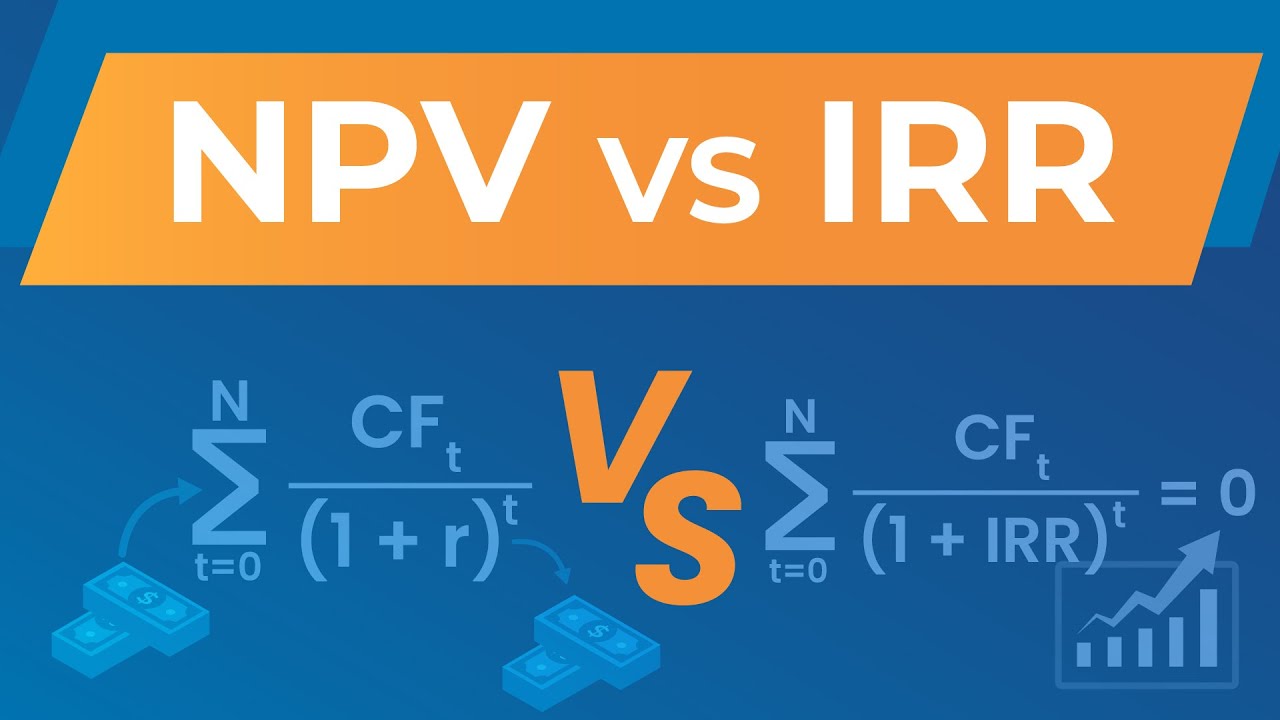

NPV vs. IRR

👉🏻 Sign up for Our Complete Finance Training with 57% OFF: https://bit.ly/3Z684AS When it comes to capital budgeting, there are various approaches to evaluating a single investment or ranking mutually exclusive ventures. According to a survey conducted by Graham and Harvey (2001), Net Present Value (NPV) and Internal Rate of Return (IRR) are among the most common techniques used in practice. There are a few differences between IRR and NPV that are worth mentioning. To begin with, it is not appropriate to rank projects using IRR — reinvesting at the same rate as IRR is unrealistic. Though, reinvesting at the same rate as the opportunity cost of capital implied by the NPV calculations is economically realistic. Hence, ranking projects based on their Net Present Value is deemed reasonable. 👇🏻Follow us on YouTube ✅ / 365financialanalyst 👇🏻Connect with us on our social media platforms: ✅Website: https://bit.ly/3o4sJTX ✅Facebook: / 365financialanalyst ✅Twitter: / 365finanalyst ✅LinkedIn: / 365financialanalyst ✅Instagram: / 365financialanalyst ✅Pinterest: / 365financialanalyst 👇🏻Prepare yourself for a career in finance with our comprehensive program👇🏻 https://bit.ly/2V1hbEi Get in touch about the training at: [email protected] Comment, like, share, and subscribe! We will be happy to hear from you and will get back to you! #NpvVsIrr #NPV #IRR #NetPresentValue #InternalRateOfReturn #Comparison #CompareNpvAndIrrMethods #NpvMethod #IrrMethod

![IRR vs. NPV - Which To Use in Real Estate [& Why]](https://image.4k-video.ru/id-video/hGw2J__2adU)