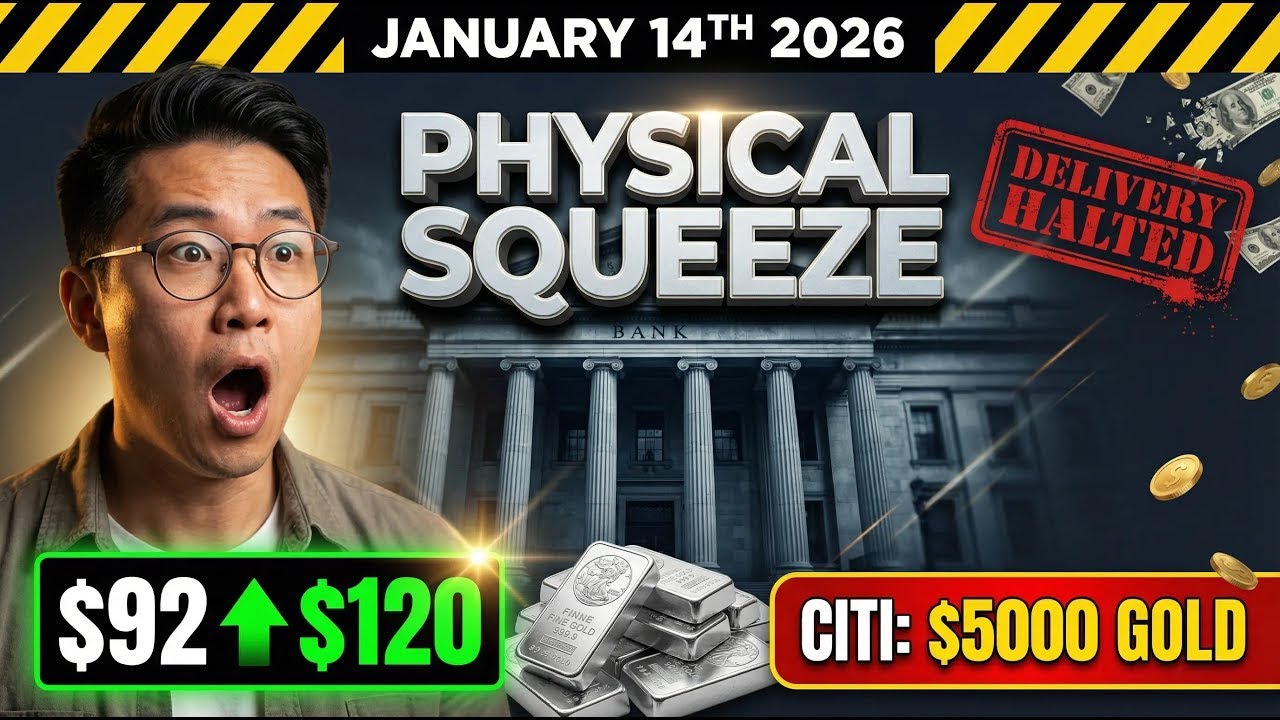

SILVER $120 IN HAND! Dealers Stop Deliveries as Citi Calls for $5,000 Gold (Jan 14, 2026) скачать в хорошем качестве

gold

silver

precious metals

gold and silver

investing in gold

investing in silver

2026 outlook

macro economy

inflation hedge

financial uncertainty

wealth protection

hard assets

central banks

gold reserves

silver demand

economic crisis

portfolio allocation

financial education

global economy

store of value

silver rounds

us dollar

how to invest in gold

silvers value

price of silver

dave ramsey

federal reserve

buying gold

market analysis

Повторяем попытку...

Скачать видео с ютуб по ссылке или смотреть без блокировок на сайте: SILVER $120 IN HAND! Dealers Stop Deliveries as Citi Calls for $5,000 Gold (Jan 14, 2026) в качестве 4k

У нас вы можете посмотреть бесплатно SILVER $120 IN HAND! Dealers Stop Deliveries as Citi Calls for $5,000 Gold (Jan 14, 2026) или скачать в максимальном доступном качестве, видео которое было загружено на ютуб. Для загрузки выберите вариант из формы ниже:

-

Информация по загрузке:

Скачать mp3 с ютуба отдельным файлом. Бесплатный рингтон SILVER $120 IN HAND! Dealers Stop Deliveries as Citi Calls for $5,000 Gold (Jan 14, 2026) в формате MP3:

Если кнопки скачивания не

загрузились

НАЖМИТЕ ЗДЕСЬ или обновите страницу

Если возникают проблемы со скачиванием видео, пожалуйста напишите в поддержку по адресу внизу

страницы.

Спасибо за использование сервиса ClipSaver.ru

SILVER $120 IN HAND! Dealers Stop Deliveries as Citi Calls for $5,000 Gold (Jan 14, 2026)

1. Silver at $92, Physical at $120: The Paper Price Is Breaking 2. The Great Silver Disconnect: When Screens Lie and Metal Vanishes 3. Hold the Bars: Inside the Physical Silver Breakdown of January 2026 4. Paper Promises vs Real Metal: The Silver Market’s Point of No Return 5. When 300 Claims Chase One Ounce: Silver’s Systemic Failure Exposed Today is January 14th, 2026, and the precious metals market has crossed a line it cannot uncross. Silver has surged past $91 and gold is charging toward $4,600, but the real story isn’t what you see on your trading screen. The real story is what happens when you actually try to buy metal. Across the US and UK, investors are discovering that the “price” of silver no longer reflects reality. Spot may read $92, but physical silver is trading between $100 and $120 per ounce, if you can find it at all. Subscribers are reporting unfilled orders placed weeks ago at prices under $80. Major dealers have halted sales of junk silver and scrap entirely. Inventory for standard products like 1 oz rounds, 10 oz bars, and American Silver Eagles vanished in days. This is not a demand spike. It is a structural failure. For the first time in modern history, the paper silver market and the physical silver market have fully separated. Futures, ETFs, and quoted spot prices continue to trade as if metal is abundant. Meanwhile, the real-world supply chain is freezing. Refineries can’t afford to operate because silver lease rates have exploded from around 2% annually to over 100% in a matter of days. When it costs that much just to borrow metal, production stops. No refining means no blanks. No blanks means no coins. That is why the US Mint has suspended American Silver Eagle sales altogether. Not because silver is “too expensive,” but because the system connecting paper prices to physical delivery has broken down. At the same time, China’s January 1st export restrictions removed roughly 120 million ounces of silver from global tradable supply overnight. Shanghai premiums immediately jumped double digits above Western prices, confirming that $92 is a fiction. While retail investors struggle to source metal, institutions are quietly repositioning. Goldman Sachs reports over a third of institutional investors now expect $5,000 gold by the end of 2026. Citi abruptly raised near-term gold forecasts toward $4,000. Central banks have been buying gold for 18 straight months. They are not chasing momentum. They are responding to a system where paper claims vastly exceed physical reality. Silver exposes this problem first because it is smaller, tighter, and heavily leveraged. Estimates suggest roughly 300 paper claims exist for every physical ounce. As registered inventories collapse and silver trades in backwardation, that leverage is no longer theoretical. It is being tested in real time. Cash settlements, delivery delays, and mint shutdowns are the early warning signs. This isn’t what a normal commodity rally looks like. You can still buy oil when oil rises. You can still buy homes when prices climb. But with silver, the posted price no longer guarantees access. The number on the screen and the metal in your hand have become two different things. This video breaks down why that happened, what it means for paper ETFs, why physical premiums are not “temporary,” and how this repricing is likely to unfold next. The great break we warned about is no longer ahead of us. It’s already here.