Covered Call ETFs: What Are the Risks? скачать в хорошем качестве

Повторяем попытку...

Скачать видео с ютуб по ссылке или смотреть без блокировок на сайте: Covered Call ETFs: What Are the Risks? в качестве 4k

У нас вы можете посмотреть бесплатно Covered Call ETFs: What Are the Risks? или скачать в максимальном доступном качестве, видео которое было загружено на ютуб. Для загрузки выберите вариант из формы ниже:

-

Информация по загрузке:

Скачать mp3 с ютуба отдельным файлом. Бесплатный рингтон Covered Call ETFs: What Are the Risks? в формате MP3:

Если кнопки скачивания не

загрузились

НАЖМИТЕ ЗДЕСЬ или обновите страницу

Если возникают проблемы со скачиванием видео, пожалуйста напишите в поддержку по адресу внизу

страницы.

Спасибо за использование сервиса ClipSaver.ru

Covered Call ETFs: What Are the Risks?

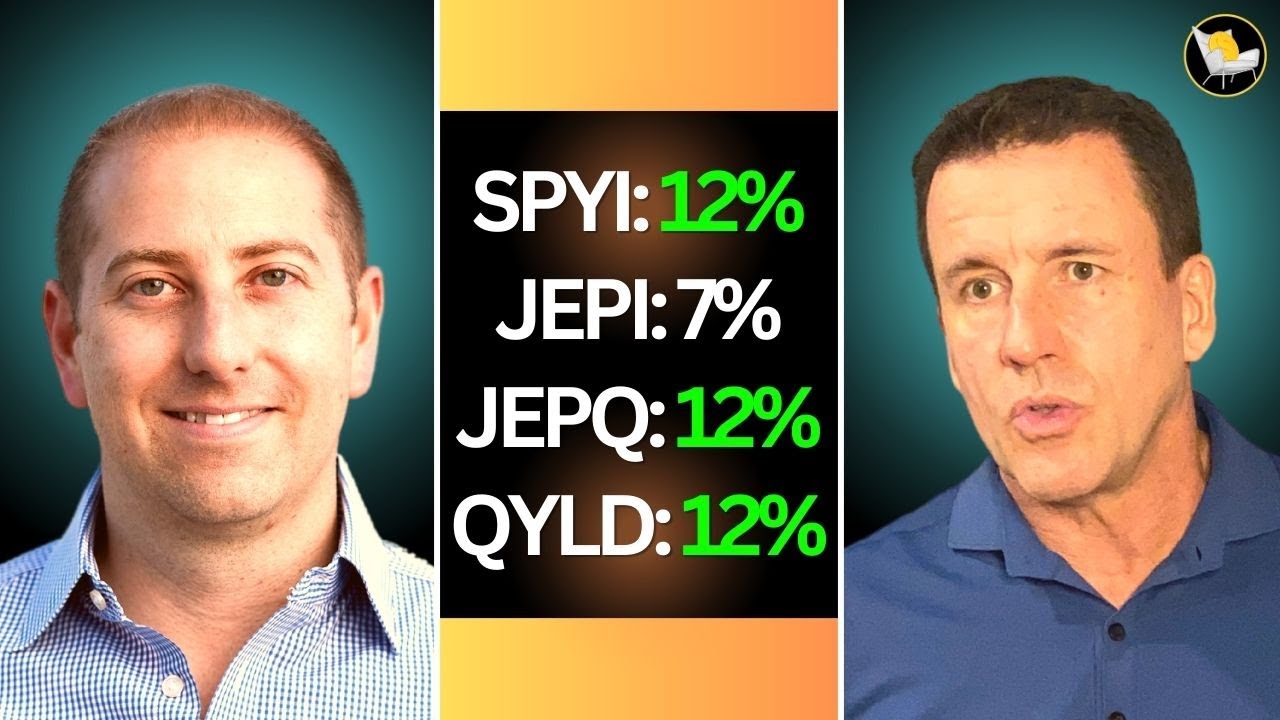

A discussion of the the risks of Covered Call ETFs. I'm joined by Garrett Paolella, who overseas $1B of option based ETFs at NEOS. We discuss using covered call ETFs to beat inflation, and what to look for when choosing a covered call ETF. Funds including JEPI, JEPQ, SPYI, and QYLD have been increasingly popular in recent years because they deliver yields of 7-12% while offering diversification and the stability of major indexes including the S&P 500. Before investing in these funds, I highly recommend watching this discussion! (my apologies for the sound being a bit off...will be buying a new mic before the next video!). 0:00 Preview 0:30 Do you think Covered Call ETFs offer the best ratio of yield to risk? 1:44 Garrett's background 3:02 Will distributions drop when the price drops? (Very Important!!) 4:18 What do people misunderstand about Covered Call ETFs? 4:42 Which strategy is better...Out of the Money or At the Money? 5:50 Will an Out of the Money fund recover faster after a correction? 6:16 What percentage of the portfolio do you write Covered Calls on? 8:12 Who much would you personally allocated to Covered Call ETFs? 9:00 How do you tell which Return of Capital is "good" vs "bad"? 9:55 Is there a way to assess the risk of ELN's (Equity Linked Notes)? 11:54 What do you think about DIY...doing your own Covered Calls? 14:20 Why is QYLD so popular? 16:55 How can an investor stay ahead of inflation? 19:52 Who should buy Covered Call ETFs and Who Shouldn't? 20:27 What About "Put" option strategies? 22:11 What's up with all the new covered call ETFs coming onto the market every week?? ➡️ My Favorite Dividend Tracker, Snowball: (Create a Free Account, and the 10% Discount will appear under "Subscribe"): https://armchairincome.link/snow ✏️ LINKS FROM TODAY'S EPISODE: What is a Covered Call? (Short Video): • How Do Covered Call ETFs Pay Such High Yie... Garrett's ETF (SPYI Review): • SPYI Squeezes 12% Yield from the S&P 500 (... 📊 RESEARCH TO BOOST YOUR RETURNS: ➡️ Seeking Alpha ($50 Coupon +Free Trial): https://armchairincome.link/SeekingAlpha ➡️ How to Find Dividend Stocks Using Seeking Alpha: • Top 5 Dividend Investing Tools ➡️ The REIT Forum (10% Discount Exclusive to Armchair Income Viewers): https://armchairincome.link/The.REIT.... 📈 STOCK BROKERS: ➡️ Interactive Brokers (Excellent for Non-US): https://armchairincome.link/ib 💰My Top 10 Favorite High Yield Investments (Playlist): • Top 10 High Yield Favorites ======================================= 🤓 DETAILED INFORMATION: ✅ Seeking Alpha: My #1 source of income investment information. I've been a subscriber for more than 6 years and my favorite feature is the collection of analysis articles for any given stock or fund. https://www.sahg6dtr.com/R42XQZ/R74QP/ ✅ Interactive Brokers: If you're not a US Citizen or Resident, you can still invest in US stocks and funds using Interactive Brokers. They also provide currency exchange and access to other stock exchanges around the world. https://armchairincome.link/ib ------------------------------------------------------ The information on this Youtube Channel and the resources available are for educational and informational purposes only and should not be construed as financial advice. Always do your own research before investing. Some links provided above may be associated with affiliate programs. If so, use of those links will not incur any additional cost to the user (and will, in many cases, provide a benefit to the user) and may result in a referral commission to this channel. #armchairincome #seekingalpha #covered call #ad Edited with Gling AI: https://bit.ly/46bGeYv