Mineral Value Chain and Mineral Exploration as Business скачать в хорошем качестве

Повторяем попытку...

Скачать видео с ютуб по ссылке или смотреть без блокировок на сайте: Mineral Value Chain and Mineral Exploration as Business в качестве 4k

У нас вы можете посмотреть бесплатно Mineral Value Chain and Mineral Exploration as Business или скачать в максимальном доступном качестве, видео которое было загружено на ютуб. Для загрузки выберите вариант из формы ниже:

-

Информация по загрузке:

Скачать mp3 с ютуба отдельным файлом. Бесплатный рингтон Mineral Value Chain and Mineral Exploration as Business в формате MP3:

Если кнопки скачивания не

загрузились

НАЖМИТЕ ЗДЕСЬ или обновите страницу

Если возникают проблемы со скачиванием видео, пожалуйста напишите в поддержку по адресу внизу

страницы.

Спасибо за использование сервиса ClipSaver.ru

Mineral Value Chain and Mineral Exploration as Business

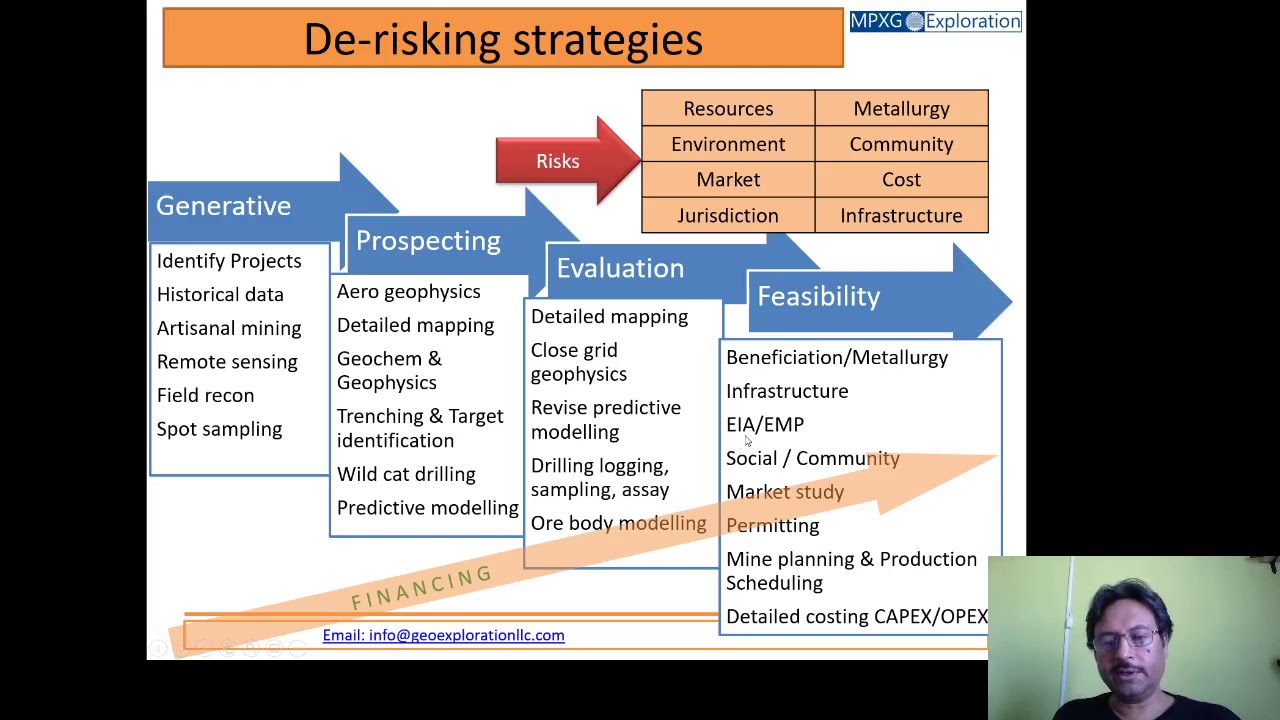

Mineral Exploration as Business: The Mineral Industry value chain starts with a greenfield reconnaissance concession as its primary raw material. Value is added to the primary raw material through geological work and it progresses through the stages of prospecting, exploration, feasibility, mining, processing and mineral based industries. The value of the tenement progressively increases with every de-risking activity. Objective is to systematically address all potential risks to a feasible mine and provide a fully de-risked property for mining. The early stage part of the mineral industry value chain from greenfield prospecting to feasibility is the space where exploration businesses operate. There are generative businesses at lower end of this chain that specialize in early stage project identification. Then there are exploration businesses that develop these projects through surface exploration and preliminary drilling to target identification. And finally there are advanced explores that complete detailed drilling, beneficiation tests, economic analysis and feasibility. These are broad zones with some companies specializing into one activity and some having broader scope. Primary raw material for this exploration value chain is an exploration tenement and the final product is a feasible fully permitted mining lease which in turn becomes raw material for the miner. As their projects progress, explorers raise finance through innovative tools like discounted valuation, warrants, options, private equity placements, share sales, joint ventures, pledging future production, forward selling property etc. This finance is primarily used to further the project de- risking. Every round of financing is done at progressively higher valuation as the exploration work adds value to the tenement and consequently accrues capital gains to the owners of the shares of the explorer. As the explorer keeps declaring good results and moving towards feasibility the value of their company shares can rise multifold in a very short time. Early investors stand to gain multiple times their investment in successful projects sometimes over 500% in one year.