The Mortgage Racism Scam: Why Black Borrowers Pay Infinitely More (Even With Perfect Credit) скачать в хорошем качестве

Повторяем попытку...

Скачать видео с ютуб по ссылке или смотреть без блокировок на сайте: The Mortgage Racism Scam: Why Black Borrowers Pay Infinitely More (Even With Perfect Credit) в качестве 4k

У нас вы можете посмотреть бесплатно The Mortgage Racism Scam: Why Black Borrowers Pay Infinitely More (Even With Perfect Credit) или скачать в максимальном доступном качестве, видео которое было загружено на ютуб. Для загрузки выберите вариант из формы ниже:

-

Информация по загрузке:

Скачать mp3 с ютуба отдельным файлом. Бесплатный рингтон The Mortgage Racism Scam: Why Black Borrowers Pay Infinitely More (Even With Perfect Credit) в формате MP3:

Если кнопки скачивания не

загрузились

НАЖМИТЕ ЗДЕСЬ или обновите страницу

Если возникают проблемы со скачиванием видео, пожалуйста напишите в поддержку по адресу внизу

страницы.

Спасибо за использование сервиса ClipSaver.ru

The Mortgage Racism Scam: Why Black Borrowers Pay Infinitely More (Even With Perfect Credit)

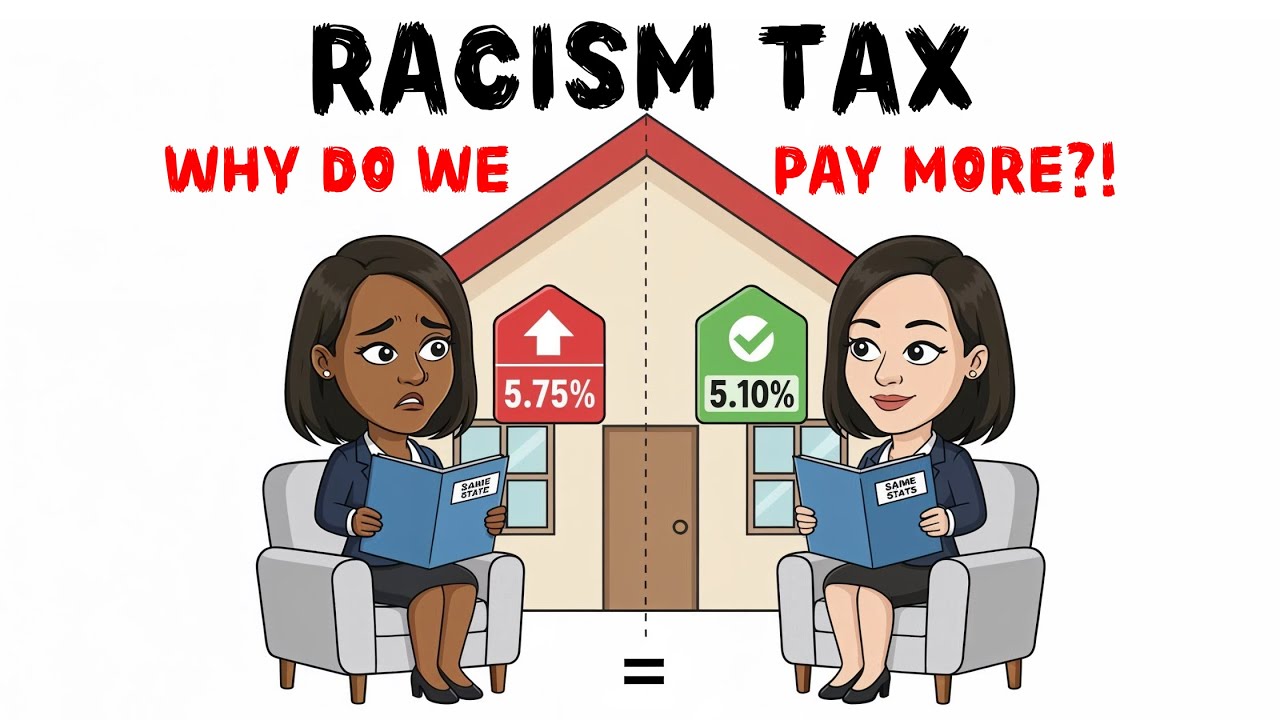

In this video, we’re breaking down mortgage lending in America and how housing discrimination still shows up in 2026 — not through obvious “we don’t lend to you” signs, but through systems that create systemic racism with plausible deniability. We’ll look at how a tiny rate difference turns into tens of thousands of dollars, why loan denial rates stay higher even when credit profiles match, and how all of this fuels long-term **economic disparity and the racial wealth gap. If you’ve ever done everything “right” — strong credit, stable income, real savings — and still felt like the game is rigged, you’re not imagining it. The most infuriating part is how modern discrimination hides behind algorithms, zip codes, and appraisals so it’s hard to prove in any one case… even while the pattern stays consistent across millions of borrowers. I’ll walk you through the math of how a half-point interest gap becomes generational wealth extraction, the specific mechanisms that create unequal outcomes (appraisal bias, risk scoring, discretionary pricing, and algorithmic underwriting), and the practical steps to protect yourself: shopping lenders, challenging appraisals, documenting everything, and knowing exactly what to compare so you can spot the “fair on paper” trap before it costs you years of wealth. 👉 Subscribe for more insights on achieving financial freedom! / @aliciainvestsus ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬ 🔵 Relevant hashtags: #personalfinance #investing #investingforbeginners #wealthbuilding #moneymindset #moneytips #financialfreedom #passiveincome #stockmarket #indexfunds #etfs #dividendinvesting #budgeting #savingmoney #debtfreejourney #retireearly #financialliteracy #moneymanagement #sidehustle #buildwealth ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬ ‼️ Disclaimer ‼️ I’m not a financial advisor, lawyer, therapist, or any other licensed professional. The content on this channel is for educational and entertainment purposes only. Everything shared here reflects my personal opinions and should not be taken as financial, investment, legal, medical, or relationship advice. Any stories, examples, or characters used are composite illustrations meant to explain ideas, not to represent real people or specific situations. Real-life outcomes vary widely because everyone’s circumstances are different, and any statistics referenced may come from studies with limitations and may not apply to every individual. Always do your own research and consider your full situation before making important decisions. When needed, consult a qualified professional who understands your personal circumstances.

![Global Capitalism: The Changing World Economy [May 2023]](https://imager.clipsaver.ru/WcI4XQA5nzA/max.jpg)

![Биология поведения человека. Лекция #1. Введение [Роберт Сапольски, 2010. Стэнфорд]](https://imager.clipsaver.ru/ik9t96SMtB0/max.jpg)