Скачать с ютуб 🔴 1-2-3 ELLIOTT WAVE (Simplified Guide) - The easiest way to MASTER Elliott Wave Theory в хорошем качестве

Скачать бесплатно и смотреть ютуб-видео без блокировок 🔴 1-2-3 ELLIOTT WAVE (Simplified Guide) - The easiest way to MASTER Elliott Wave Theory в качестве 4к (2к / 1080p)

У нас вы можете посмотреть бесплатно 🔴 1-2-3 ELLIOTT WAVE (Simplified Guide) - The easiest way to MASTER Elliott Wave Theory или скачать в максимальном доступном качестве, которое было загружено на ютуб. Для скачивания выберите вариант из формы ниже:

Загрузить музыку / рингтон 🔴 1-2-3 ELLIOTT WAVE (Simplified Guide) - The easiest way to MASTER Elliott Wave Theory в формате MP3:

Если кнопки скачивания не

загрузились

НАЖМИТЕ ЗДЕСЬ или обновите страницу

Если возникают проблемы со скачиванием, пожалуйста напишите в поддержку по адресу внизу

страницы.

Спасибо за использование сервиса savevideohd.ru

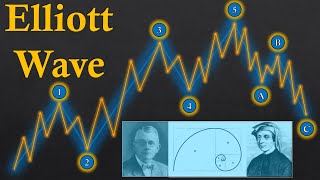

🔴 1-2-3 ELLIOTT WAVE (Simplified Guide) - The easiest way to MASTER Elliott Wave Theory

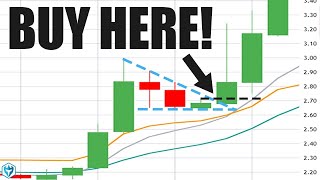

🔴 FREE DOWNLOAD TRADING SYSTEM: https://traderversity.com/forex-stock... https://forexwot.com/forex-multi-gann... https://traderversity.com/multi-ema-m... https://forexwot.com/guppy-fast-trend... 1-2-3 ELLIOTT WAVE (Simplified Guide) - The easiest way to MASTER Elliott Wave Theory ------------------------------------ Elliott Wave Price Action Trading Strategy ------------------------------------- Step #1 Wait until you can spot at least a 3 wave Elliott Wave sequence. ----------------- The first step in the Elliott Wave strategy is to wait until you can identify a 3 wave sequence. The good thing about the Elliott Wave strategy is that it doesn’t require any technical indicator as it’s a pure price action strategy. Trading in the direction of the trend, the goal is to capture the last wave 5. To do this, traders must observe the first 3 waves of a five-wave pattern and verify that they comply with Elliott Wave rules. For instance, in a bearish Elliott wave count, the wave count must adhere to the rules for the Elliott Wave strategy, allowing for a sell setup. Once this is established, the next step is to search for the Elliott Wave entry points. Step #2: BUY Between 50% and 61.8% Fibonacci Retracement of Wave 3 ----------------- According to one of the main rules of Elliott Wave theory, ideally, wave 4 should retrace between 50% and 61.8% of the Fibonacci retracement of wave 3. To avoid missing out on potential movements, we set our entry point for Elliott Wave between 50% and 61.8% based on price action signals formed in that area. In many cases, bullish engulfing and bullish pin bar patterns often appear in this area. However, experience can help refine this entry point for better accuracy. Step #3: Set the Protective Stop Loss a few pips below the swing low. ----------------- It is advisable to place your stop loss a few pips below the recent swing low. This is because this position ensures that your stop loss is not too large or too small. The purpose of this is to help you achieve your Money Management target, which is a Risk Reward Ratio of 1:3. After setting the protective stop loss, the next crucial aspect of the Elliott Wave strategy is to determine the profit-taking strategy. Step #4: Decide when to take profit based on your Stop Loss. ----------------- Once you have determined your Stop Loss level, it is important to set a profit target that is three times the size of your Stop Loss. This ensures that, in the long run, your trades will remain profitable.The beauty of the Elliott Wave strategy is that it allows for experimentation and the development of unique trading approaches. Once you have a solid understanding of how to trade using Elliott Wave principles, you can create multiple strategies that work best for you. As such, there is no specific take-profit strategy that applies to every Elliott Wave structure. The strategy is flexible because every structure is different and maximizing profits requires adaptability.

![🔴 Guppy MMA - This is The Trading Strategy The Top 5% Traders Use...[Secret To BIG Profits]](https://i.ytimg.com/vi/3PRVNZ0s18w/mqdefault.jpg)