Скачать с ютуб How to Calculate Basis for S Corporation Stock в хорошем качестве

Скачать бесплатно и смотреть ютуб-видео без блокировок How to Calculate Basis for S Corporation Stock в качестве 4к (2к / 1080p)

У нас вы можете посмотреть бесплатно How to Calculate Basis for S Corporation Stock или скачать в максимальном доступном качестве, которое было загружено на ютуб. Для скачивания выберите вариант из формы ниже:

Загрузить музыку / рингтон How to Calculate Basis for S Corporation Stock в формате MP3:

Если кнопки скачивания не

загрузились

НАЖМИТЕ ЗДЕСЬ или обновите страницу

Если возникают проблемы со скачиванием, пожалуйста напишите в поддержку по адресу внизу

страницы.

Спасибо за использование сервиса ClipSaver.ru

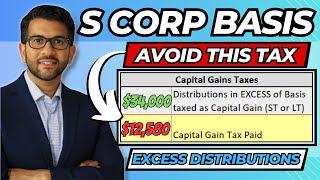

How to Calculate Basis for S Corporation Stock

A shareholder's basis in S corporation stock is calculated by making a series of upward and downward adjustments to the shareholder's initial stock basis. You can calculate a shareholder's basis in S corporation stock as follows: initial basis capital contributions ordinary income (pro rata share) separately stated income (pro rata share) tax-exempt income (pro rata share) non-oil and non-gas depletion in excess of the property's basis (pro rata share) distributions not reported as income nondeductible, noncapital expenses such as fines and penalties (pro rata share) ordinary loss (pro rata share) separately stated loss and deductions (pro rata share) oil and gas depletion that doesn't exceed the property's basis (pro rata share) = new basis Adjustments are made in a certain order. Here are the ordering rules: (1) basis is first increased by the pro rata share of income items and excess depletion (2) basis is next decreased by distributions (3) basis is then decreased by nondeductible, noncapital expenses* (4) basis is finally decreased by deductions and losses *A shareholder can elect to have losses reduce their stock basis before accounting for nondeductible, noncapital expenses. Note that a shareholder's basis in S corporation stock can never go below zero (a negative basis isn't possible). — Edspira is the creation of Michael McLaughlin, an award-winning professor who went from teenage homelessness to a PhD. Edspira’s mission is to make a high-quality business education freely available to the world. — SUBSCRIBE FOR A FREE 53-PAGE GUIDE TO THE FINANCIAL STATEMENTS, PLUS: • A 23-PAGE GUIDE TO MANAGERIAL ACCOUNTING • A 44-PAGE GUIDE TO U.S. TAXATION • A 75-PAGE GUIDE TO FINANCIAL STATEMENT ANALYSIS • MANY MORE FREE PDF GUIDES AND SPREADSHEETS http://eepurl.com/dIaa5z — SUPPORT EDSPIRA ON PATREON * / prof_mclaughlin — GET CERTIFIED IN FINANCIAL STATEMENT ANALYSIS, IFRS 16, AND ASSET-LIABILITY MANAGEMENT https://edspira.thinkific.com — LISTEN TO THE SCHEME PODCAST Apple Podcasts: https://podcasts.apple.com/us/podcast... Spotify: https://open.spotify.com/show/4WaNTqV... Website: https://www.edspira.com/podcast-2/ — GET TAX TIPS ON TIKTOK / prof_mclaughlin — ACCESS INDEX OF VIDEOS https://www.edspira.com/index — CONNECT WITH EDSPIRA Facebook: / edspira Instagram: / edspiradotcom LinkedIn: / edspira — CONNECT WITH MICHAEL Twitter: / prof_mclaughlin LinkedIn: / prof-michael-mclaughlin — ABOUT EDSPIRA AND ITS CREATOR https://www.edspira.com/about/ https://michaelmclaughlin.com