Скачать с ютуб GST Bill Explained | Summary, Mechanism, History, Architect, GST Council, Structure в хорошем качестве

gst

gst bill

what is gst

gst explained

vat

gst registration process

gst registration

gst bill explained

gst council

summary of gst

history

mechanism

summary

direct tax

indirect tax

gst rate structure

gst rates

goods and services tax

#gstbill

gst full form

gst in india

india

india gst

all about gst in india

gst bill in hindi

what is gst tax

basics of gst

what is gst in india in hindi

gst tax

gst bill india

Скачать бесплатно и смотреть ютуб-видео без блокировок GST Bill Explained | Summary, Mechanism, History, Architect, GST Council, Structure в качестве 4к (2к / 1080p)

У нас вы можете посмотреть бесплатно GST Bill Explained | Summary, Mechanism, History, Architect, GST Council, Structure или скачать в максимальном доступном качестве, которое было загружено на ютуб. Для скачивания выберите вариант из формы ниже:

Загрузить музыку / рингтон GST Bill Explained | Summary, Mechanism, History, Architect, GST Council, Structure в формате MP3:

Если кнопки скачивания не

загрузились

НАЖМИТЕ ЗДЕСЬ или обновите страницу

Если возникают проблемы со скачиванием, пожалуйста напишите в поддержку по адресу внизу

страницы.

Спасибо за использование сервиса savevideohd.ru

GST Bill Explained | Summary, Mechanism, History, Architect, GST Council, Structure

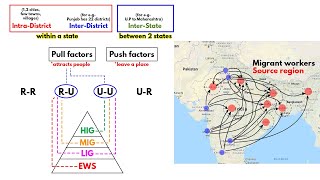

Good and services tax GST India Rate Structure are also Explained. GST Bill or Goods and Services Tax will be implemented in India on 1st July 2017. This Video Explains - What is GST, History of GST, GST Mechanism / model, who is the architect of GST, GST Full Form, Its Rate Structure, and Advantage of GST, GST for competitive exams (UPSC / IAS / SSC CGL / CDS / NDA / Bank PO) TIME STAMP Tax structure in India - 2:08 Concerned Authority - 3:00 History of GST and its architect - 4:23 Explaining the GST Model / Mechanism - 6:03 GST Council - 10:34 GST Tax Slabs - 11:37 This new Tax Structure is the collection of all the previous types of Tax like Sale Tax, VAT, Entertainment Tax, Service Tax, and Income Tax etc. Goods and Services Tax is of three types CGST, SGST, and IGST. According to economist GST will not affect Governments profit that much but increase Indian Economy by 4.2%. 7 Tax Slabs are formed for GST Bill in India Nil, 0.25%, 3%, 5%, 12%, 18%, and 28% Nil Tax Slab Contains - Fresh Meat, Eggs, Milk, Curd, Natural Honey, Fruits, Vegitables, Bread, Prashad, Salt, Bindi, Sindoor, Books, Paper, Newspaper, & Hotels with price less than Rs 1,000. 5% Tax Slab - Packed Food Items, Clothes below Rs 1,000 , Footwear below Rs 500, Tea, Coffee, Pizza, Kerosene, Coal, Medicines, Transport Service like Railway and Air Transport. 12% Tax Slab - Clothes above Rs 1,000 , Butter, Cheese, Dry Fruits(Packed), Ayurvedic Medicines, Fruit Juice, Agarbatti, Cell Phones and Business Class Air Tickets. 18% Tax Slab - Footwear above Rs 500, Biscuits, Cakes, Mineral Water, Camera and Other Electronics Product, and Telecom Services. 28% Tax Slab - Alcohol, Cigarettes, Pan Masala, Paint, Deo and Big Machines. Fill this feedback form for a better learning experience https://goo.gl/vrYPBw Click here if you want to subscribe / therealsengupta Maps and sketches can be found on the instagram account search for "geographysimple"

![Как устроен QR-код? [Veritasium]](https://i.ytimg.com/vi/nKY00hHtIxg/mqdefault.jpg)