The Credit Multiplier and Divider - Explain Economics to Me скачать в хорошем качестве

Повторяем попытку...

Скачать видео с ютуб по ссылке или смотреть без блокировок на сайте: The Credit Multiplier and Divider - Explain Economics to Me в качестве 4k

У нас вы можете посмотреть бесплатно The Credit Multiplier and Divider - Explain Economics to Me или скачать в максимальном доступном качестве, видео которое было загружено на ютуб. Для загрузки выберите вариант из формы ниже:

-

Информация по загрузке:

Скачать mp3 с ютуба отдельным файлом. Бесплатный рингтон The Credit Multiplier and Divider - Explain Economics to Me в формате MP3:

Если кнопки скачивания не

загрузились

НАЖМИТЕ ЗДЕСЬ или обновите страницу

Если возникают проблемы со скачиванием видео, пожалуйста напишите в поддержку по адресу внизу

страницы.

Спасибо за использование сервиса ClipSaver.ru

The Credit Multiplier and Divider - Explain Economics to Me

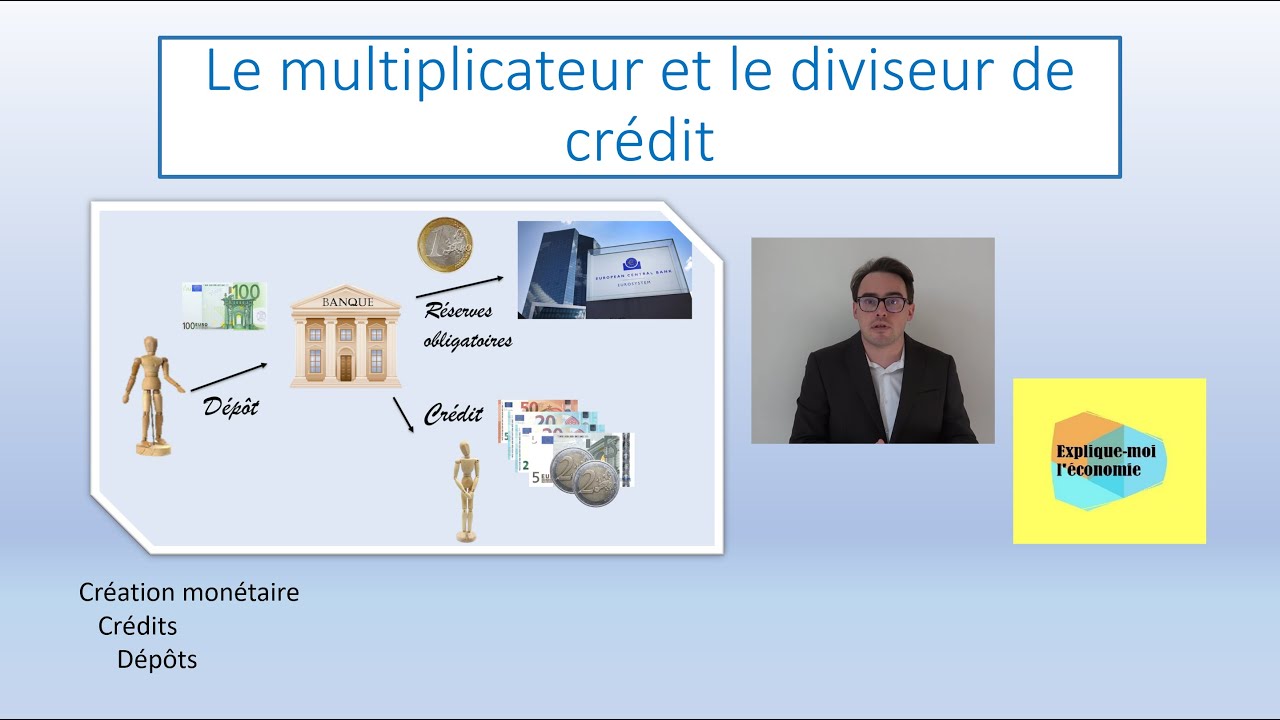

This issue of Explain Economics revisits the credit multiplier and the credit divider. It seeks to answer the question of where money creation comes from by presenting these two conceptions of money creation. According to the credit multiplier, customer deposits allow banks to grant new credits, which in turn will give new deposits that will then be lent on again. Thus, this conception can be summarized by the idea that deposits make credits. Indeed, an initial deposit will lead, through successive credits and deposits, to a much greater monetary creation than the amount of the initial deposit. Banks would be limited by the fractional reserve system, with compliance with the required reserve ratio, thus limiting their ability to grant new credits following a deposit. This vision has limits, in particular the fact that banks can be prudent and not grant all the credits they could, similarly the demand for credit can be limited and banks must comply with other regulations. According to the credit divider, money would be endogenous, that is to say that monetary creation will be influenced by the demand for credit rather than by the simple amount of deposits. Thus, this concept can be summarized by the idea that credits make deposits. Indeed, the demand for credits would be at the origin of monetary creation, once these are granted, they will result in deposits. The mandatory reserve ratio then plays a secondary role. Indeed, banks will subsequently establish, according to the volume of credit granted, the necessary reserves, by borrowing on the interbank market or from the Central Bank. To influence the amount of credit granted, and therefore monetary creation, the central bank will then modify its key interest rates. Issue plan: 00:00 Introduction 01:45 I – The credit multiplier: deposits make credits 01:47 1°) What is the credit multiplier? 07:05 2°) Criticisms of the credit multiplier 09:23 II – The credit divider: credits make deposits 09:26 1°) What is the credit divider? 01:44 2°) The role of central banks 14:07 Conclusion Numbers cited or related to this video: The traditional monetary policy of the ECB: • La politique monétaire traditionnelle de l... Playlist "Macroeconomics": • Macroéconomie Subscribe to Explain the economy to me: https://www.youtube.com/c/Expliquemoi... Find us also on the website of Explain the economy to me: https://www.explainmoileconomie.com/ On Facebook: / explainmoileconomie And on Instagram: / explainmoileconomie