Скачать с ютуб How to Create and Manage Multiple GST Registrations in TallyPrime | TallyHelp в хорошем качестве

tally

tally solutions

ERP

tally for big business

erp software

tally gst

accounting software

tally server

tally accounting

TallyPrime

business management software

gst software

tally inventory

inventory software

TallyPrime 3.0

TallyPrime Release 3.0

Multiple GST Registrations

Multiple GST Registrations in one company

company with multiple GST registration

maintain multiple gst registration in TallyPrime

create multiple gst registration in a single company

Скачать бесплатно и смотреть ютуб-видео без блокировок How to Create and Manage Multiple GST Registrations in TallyPrime | TallyHelp в качестве 4к (2к / 1080p)

У нас вы можете посмотреть бесплатно How to Create and Manage Multiple GST Registrations in TallyPrime | TallyHelp или скачать в максимальном доступном качестве, которое было загружено на ютуб. Для скачивания выберите вариант из формы ниже:

Загрузить музыку / рингтон How to Create and Manage Multiple GST Registrations in TallyPrime | TallyHelp в формате MP3:

Если кнопки скачивания не

загрузились

НАЖМИТЕ ЗДЕСЬ или обновите страницу

Если возникают проблемы со скачиванием, пожалуйста напишите в поддержку по адресу внизу

страницы.

Спасибо за использование сервиса ClipSaver.ru

How to Create and Manage Multiple GST Registrations in TallyPrime | TallyHelp

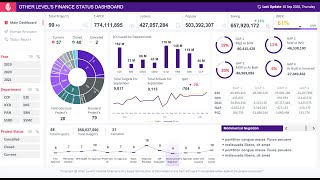

Applicable to Release 3.0 and later Start your free trial: http://bit.ly/3EM4Drl TallyPrime Release 3.0 brings the multiple GST registrations feature, which allows you to have more than one GSTIN in a single Company. You can record transactions belonging to each GST registration. Moreover, you can view reports for all the GSTINs or a specific GSTIN, as per your requirement. The facility helps you avoid maintaining multiple Companies for recording transactions of more than one GST registration. This video shows the procedure to use the multiple GST Registrations feature introduced in TallyPrime Release 3.0. The video covers: 00:00 - Title 01:05 - Creating Multiple GST Registrations in Company 05:16 - Recording Transactions for a Specific GST Registration 06:44 - Setting Default GST Registration for a Specific Voucher Type 07:36 - Common Voucher Numbering for All GST Registrations in Voucher Types 08:28 - Viewing Reports for Multiple or a Specific GST Registration 09:31 - Export GST Returns for Single and All GST Registrations Have a question? Refer to: https://help.tallysolutions.com/ Write/Chat/Call us: https://tallysolutions.com/support/ Click here for the free trial http://bit.ly/3EM4Drl Connect with us on: Facebook : / tallysolutions Twitter : / tallysolutions LinkedIn : / tallysolutions Website : https://www.tallysolutions.com/