Скачать с ютуб Fair Lending Analysis for Auto Lending в хорошем качестве

Скачать бесплатно и смотреть ютуб-видео без блокировок Fair Lending Analysis for Auto Lending в качестве 4к (2к / 1080p)

У нас вы можете посмотреть бесплатно Fair Lending Analysis for Auto Lending или скачать в максимальном доступном качестве, которое было загружено на ютуб. Для скачивания выберите вариант из формы ниже:

Загрузить музыку / рингтон Fair Lending Analysis for Auto Lending в формате MP3:

Если кнопки скачивания не

загрузились

НАЖМИТЕ ЗДЕСЬ или обновите страницу

Если возникают проблемы со скачиванием, пожалуйста напишите в поддержку по адресу внизу

страницы.

Спасибо за использование сервиса ClipSaver.ru

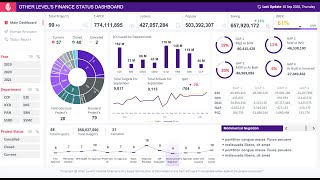

Fair Lending Analysis for Auto Lending

An easy first step in mitigating fair lending risk related to auto lending is to acquire automated fair lending software to help. Next, you’ll also want to work with internal or external fair lending resources to help you understand the data that are available and the key analyses that can be conducted. A sound fair lending monitoring tool should have the following capabilities: 1. Ability to monitor auto loans 2. Geocoding capabilities 3. Proxy methodologies for race, ethnicity, and gender 4. Statistics to measure Fair Lending 5. Reports to monitor dealer markup 6. Match Pair Analysis 7. Training conducted by fair lending industry experts ComplianceTech’s team of experts can walk you through a custom presentation to discuss your current monitoring of auto lending and how using Fair Lending Magic™ can help remove the guesswork. The tool is designed to pinpoint areas of fair lending risk while it guides you to where you should consider a more in-depth analysis. It is possible to target specific dealer’s performance and measure against fair lending objectives. The interactive dashboard allows you to visualize and track key performance metrics, enabling communication with management.