New Tip & Overtime Codes to W-2 (IRS Tax Form) скачать в хорошем качестве

Повторяем попытку...

Скачать видео с ютуб по ссылке или смотреть без блокировок на сайте: New Tip & Overtime Codes to W-2 (IRS Tax Form) в качестве 4k

У нас вы можете посмотреть бесплатно New Tip & Overtime Codes to W-2 (IRS Tax Form) или скачать в максимальном доступном качестве, видео которое было загружено на ютуб. Для загрузки выберите вариант из формы ниже:

-

Информация по загрузке:

Скачать mp3 с ютуба отдельным файлом. Бесплатный рингтон New Tip & Overtime Codes to W-2 (IRS Tax Form) в формате MP3:

Если кнопки скачивания не

загрузились

НАЖМИТЕ ЗДЕСЬ или обновите страницу

Если возникают проблемы со скачиванием видео, пожалуйста напишите в поддержку по адресу внизу

страницы.

Спасибо за использование сервиса ClipSaver.ru

New Tip & Overtime Codes to W-2 (IRS Tax Form)

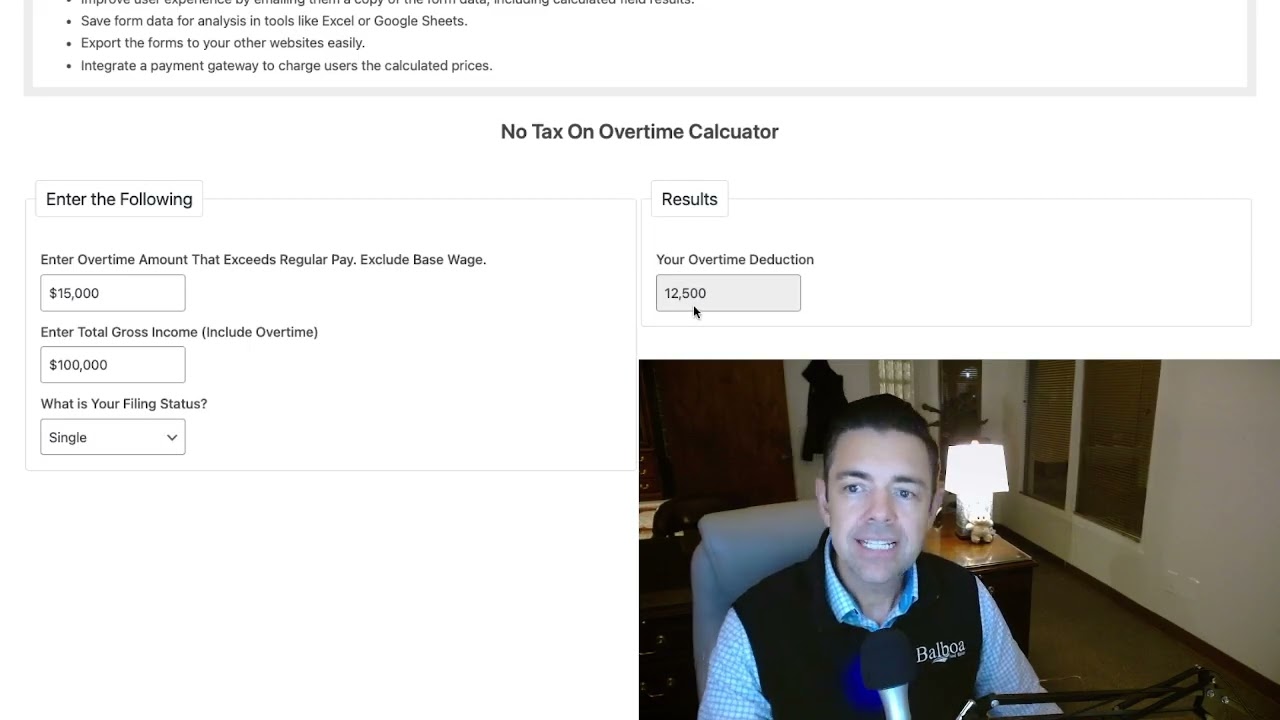

Chris Picciurro, CPA breaks down a little-known, but hugely important, update from the One Big Beautiful Bill Act (OB3): the addition of three new codes to Box 12 of the IRS Form W-2, affecting millions of workers who earn tips and overtime pay. This video also shows you a first look at the draft 2026 W-2 form recently released by the IRS, explaining exactly what’s changed and what employers, employees, and tax pros need to watch for moving forward. In this video, you’ll learn: ✅ What new W-2 Box 12 codes were added by OB3 ✅ How tips and overtime are now reported using TP and TT codes ✅ What the new TA code means for Trump-style retirement accounts ✅ How this impacts federal and state-level tax reporting ✅ Why understanding these codes is critical for employers and employees alike 🎯 Key Highlights: • OB3 introduces three new W-2 Box 12 codes for tax year 2026: • TA — Employer contributions to Trump accounts • TP — Reported cash tip income • TT — Qualified overtime compensation • These codes help clarify deductible and non-deductible income types • Tip and overtime deductions are not automatic—but must be reported to be eligible • Updates apply to all employers and states starting with 2026 W-2 filings • Employers must ensure accurate categorization and reporting of compensation

![[CB25]Cache the Frames, Catch the Vulnerabilities in Kernel Streaming](https://imager.clipsaver.ru/vi4oyDcihiM/max.jpg)