Deep xVA and a solver for BSDEs with jumps скачать в хорошем качестве

Повторяем попытку...

Скачать видео с ютуб по ссылке или смотреть без блокировок на сайте: Deep xVA and a solver for BSDEs with jumps в качестве 4k

У нас вы можете посмотреть бесплатно Deep xVA and a solver for BSDEs with jumps или скачать в максимальном доступном качестве, видео которое было загружено на ютуб. Для загрузки выберите вариант из формы ниже:

-

Информация по загрузке:

Скачать mp3 с ютуба отдельным файлом. Бесплатный рингтон Deep xVA and a solver for BSDEs with jumps в формате MP3:

Если кнопки скачивания не

загрузились

НАЖМИТЕ ЗДЕСЬ или обновите страницу

Если возникают проблемы со скачиванием видео, пожалуйста напишите в поддержку по адресу внизу

страницы.

Спасибо за использование сервиса ClipSaver.ru

Deep xVA and a solver for BSDEs with jumps

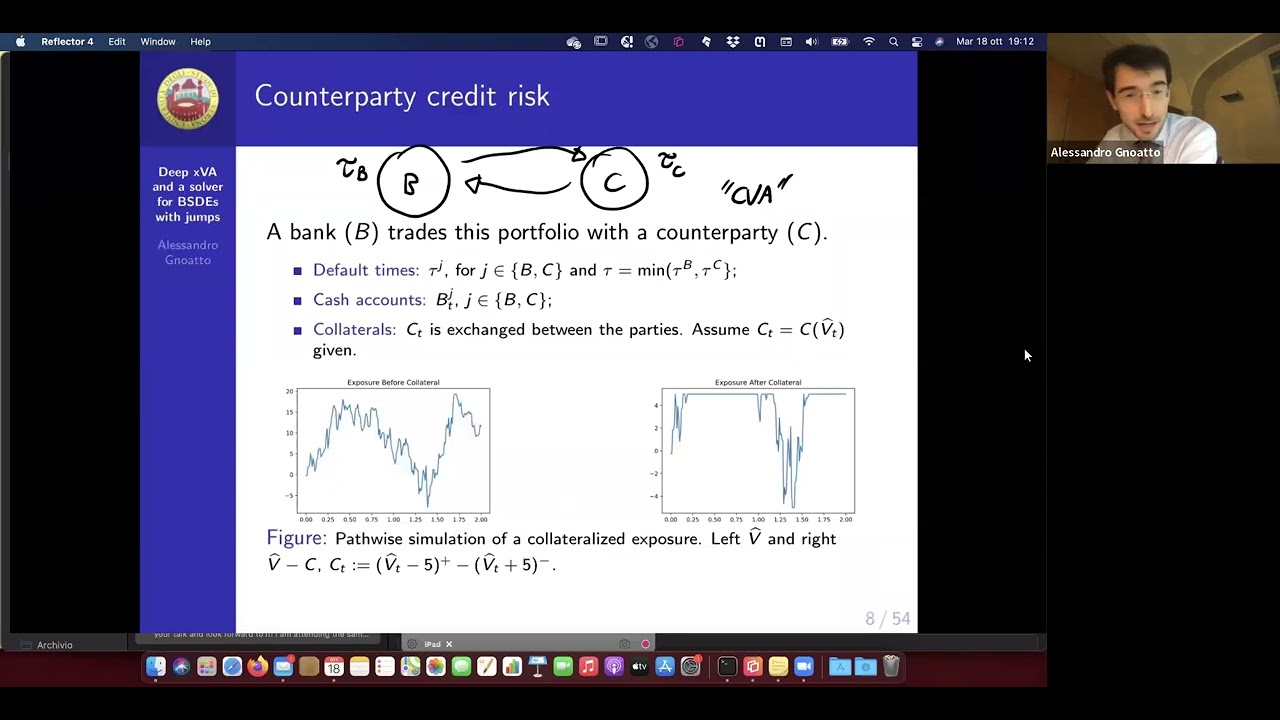

Talk at the "World Online Seminars on Machine Learning in Finance" Abstract: In the first part of the talk, we present a novel computational framework for portfolio-wide risk management problems, where the presence of a potentially large number of risk factors makes traditional numerical techniques ineffective. The new method utilises a coupled system of BSDEs for the valuation adjustments (xVA) and solves these by a recursive application of a neural network based BSDE solver. This not only makes the computation of xVA for high-dimensional problems feasible, but also produces hedge ratios and dynamic risk measures for xVA, and allows simulations of the collateral account. In the second part of the talk, we propose an extension of the Deep BSDE solver by E, Han and Jentzen (2017) to the case of FBSDEs with jumps. As in the aforementioned solver, starting from a discretized version of the BSDE and parametrizing the (high dimensional) control processes by means of a family of ANNs, the BSDE is viewed as model-based reinforcement learning problem and the ANN parameters are fitted so as to minimize a prescribed loss function. We take into account both finite and infinite jump activity, introducing in the latest case, an approximation with finitely many jumps of the forward process. This talk is based on joint works with A. Picarelli and C. Reisinger (first part) A. Picarelli and M. Patacca (second part)

![Суть линейной алгебры: #16. Абстрактные векторные пространства [3Blue1Brown]](https://image.4k-video.ru/id-video/EBN8-FyhW1U)

![Физически-информированные нейронные сети (PINN) [Машинное обучение с учетом физики]](https://image.4k-video.ru/id-video/-zrY7P2dVC4)